Information on Personal Services Income Legislation

How it affects you!

How to pass the tests!

Content here is the opinion of ICA constructed after extensive legal consideration

This first section summarises the Personal Services Income (PSI) legislation as finally passed in the Senate in late September 2001.

The key to understanding the PSI legislation is that the results test is a test for independent contractor status giving you entitlement to business-type tax treatment.The results test closely follows the common-law test for independent contracting.

This section explains how it works.

What the Personal Services Income (PSI) Legislation does

(1) The PSI legislation sets the rules that both the ATO and tax payers must follow defining who is or is not allowed to be treated as a business for tax purposes. It does this by detailing a series of tests that will determine if the tax office can treat you as a business for tax purposes. PSI does not relate to treatment as a business for GST, ABN or PAYG.

(2) If you are entitled to be treated as a business for tax purposes under PSI, you potentially:

-

- Can retain income in a company or trust (if you have one) and pay tax on the company’s or trust’s income under company tax rules.

- Make payments to partners or associates who work with you and to have those payments allowed as tax deductions from your business.

- Claim certain business expenses as tax deductions.

These are normal tax rights that every person in business has and reflect the commercial reality of how income is earned and expenses incurred when doing business.

What the final PSI Legislation says

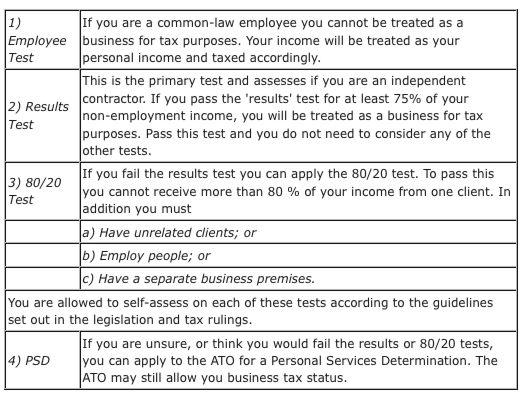

To be allowed this business tax status, the PSI legislation applies 4 major tests:

Background to how the PSI legislation developed

The PSI legislation is the end of a protracted community debate over the tax status of independent contractors. During 2001 the legislation had several forms as it was being debated through Parliament and was amended extensively before finally being passed in late September 2001.

A brief description of its development through Parliament will assist to understand the final Act.

a) The first model of the legislation appeared in early 2001. This applied the 80/20 rule as the only test. If you received more than 80% of your income from one source, you failed, and could not have business tax status. This has been changed.

b) The second model, announced around mid-2001, placed the ‘results’ test ahead of the 80/20 test. If you pass the results test, you don’t have to worry about the 80/20 rule. The results test underwent a final change in September 2001.

c) The final legislation is as described above and says that you need to passthe results test for at least 75% of your income in a year to havebusiness tax status. If you fail this test you can apply the 80/20 test.

These were the substantial amendments that impact on the core structure of the PSI legislation which affects all independent contractors. Many other amendments were passed that affect specific issues, for example, the treatment of financial planners, the rules for ATO conducted Personal Services Determinations and many others.

No tax fraud!

None of this means that a person can commit tax fraud. The PSI legislation, and ATO and government statements are clear that the anti-tax fraud provisions of the tax act (Part IVA) are, and

will continue to be, applied. You cannot use access to business tax status to illegitimately reduce your tax obligations.

Summary

Independent Contractors of Australia were active participants and lobbyists on the PSI legislation.Our conclusion on how the final legislation operates is as follows:

(1) The legislation is clear that its intent is to allow independent contractors to be treated as businesses for tax purposes.

(2) The test being used to assess if a person is an independent contractor is the results test.

(3) The results test is a legislative test that exclusively uses common-law indicators in its application. For practical purposes, it is a common-law test for independent contractors with 2 minor qualifications explained below. This conclusion is drawn from the legislation and tax rulings and is explained below.

(4) In effect, the common law-test for independent contractor status is the key to accessing business tax status.

(5) If you can pass the results/common-law test:

-

- You do not need to worry about the 80/20 rule.

- You do not need to seek a Personal Services Determination.

- You do have a right to business tax status.

This view is drawn from detailed studies of the legislation.

Conclusion

The common-law test becomes the most important item to understand and apply in accessing your right to business tax status.

More detail please!

Use the links below for more detail on each of these issues.

The reasoning behind the results test effectively being the common-law test [Immediately below]

The reasoning behind the results test effectively being the common-law test

The conclusion that the results test is in effect a common-law test for independent contracting is drawn from specific clauses in the PSI legislation and the relevant tax rulings. There are some additional elements within the PSI legislation that need to be complied with, but these elements are contained within and effectively reinforce the “traditional” common-law test.

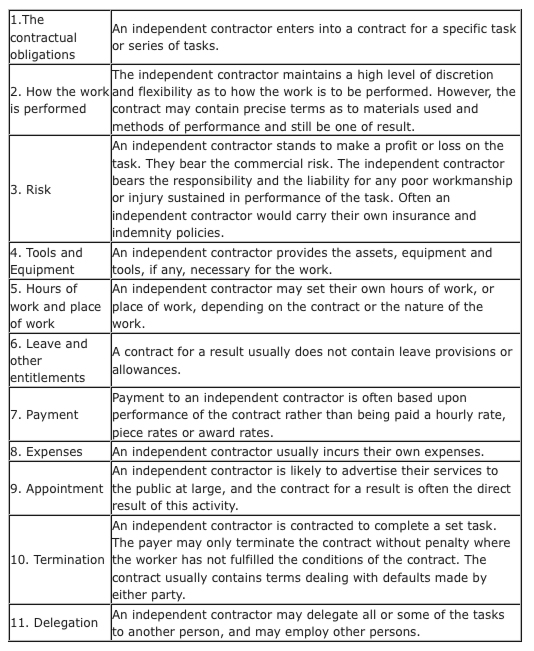

The key feature is that the PSI legislation consistently refers to the fact that “independent contractors” are not intended to be caught by the measures and that the assessment of independent contracting is to be that applied under the “traditional” test. In the absence of the legislation defining “traditional” in any other way, the view is that the word “traditional” could not be taken to mean anything other than the way in which courts traditionally assess for independent contracting, namely, the use of the common-law process.(See: Who is an Independent Contractor?)

The clauses in the PSI legislation that indicate that the results tests is, in effect, the common-law test, are taken from the amendments that elevated the ‘results test’ above the 80/20 rule, and from the relevant taxation rulings.

From Taxation Laws Amendment Bill (No 6) 2001.

“Other Amendments. Income Tax Assessment Act 1997.

17 Sections 87-1 and 87-5

Repeal the sections, substitute:

87-1 What this Division is about.

“Divisions 85 and 86 do not apply to personal services income that is income from conducting a personal services business.

It is not intended that the Divisions apply to independent contractors.

A personal services business exists if there is a personal services business determination or if one or more of 4 tests for what is a personal services business are met.

Regardless of how much your personal services income is paid from one source, you can self-assess against the results test to determine whether you are an independent contractor. The results test is based on the traditional tests for determining independent contractors and it is intended that itapply accordingly.”

From Taxation Laws Amendment Bill (No 6) 2001.

“Revised Explanatory Memorandum”

- “7.6 …. If an individual or personal services entity can meet the results test which is based on the traditional tests for determining independent contractors they will be outside the measure….”

- ‘7.35

….This will ensure that independent contractors are treated as

conducting personal services businesses and therefore, are outside the

measure….” - ‘7.41…The existing conditions for the results test (which are traditional tests for determining whether a taxpayer is an independent contractor) …“

From Taxation Ruling TR 2001/8

http://law.ato.gov.au/atolaw/view.htm?DocID=TXR/TR20018/NAT/ATO/00001

- Clause 110

“the results test is based on the traditional criteria for distinguishing independent contractors from employees. Guidance on this distinction is provided in Taxation Ruling TR 2000/14. In summary, the following factors are relevant to this distinction.

- Clause 111.

While these factors are indicative of there being a results-based contract, not all the factors need to be present for the purposes of the results test.

- Clause 112

The results test is based on the tests used to distinguish independent contractors from employees. Accordingly, there is significant overlap and the totality of the relationship between the parties will be relevant to whether the contract is properly to be constructed as one for the production of a result. This approach accords with paragraph 1.114 of the Explanatory memorandum, which says

“An individual will not satisfy the test in paragraph 87-60(5)(a) merely because the contract states that the personal services income is for producing a result.”

From Taxation Ruling TR 2000/14

- Clause 14

Where section 12-35 of Schedule 1 of the TAA refers to an employee, the reference is to an employee at common law. The relationship between and employer and employee is a contractual one. It is often referred to as a contract of service (or in the past as a master/servant relationship) Such a relationship is typically contrasted with the independent contractor/principal relationship that, at law, is referred to as a contract for services. An independent contractor typically contracts to achieve a result whereas an employee contracts to provide his or her labour (typically to enable the employer to achieve a result). An independent contractor works in his or her own business (or on his or her own account) while an employee works in the service of the employer.

Conclusion

(1) The weight of evidence within the PSI legislation is that

- The intent of the legislation is to exclude independent contractors

from the measures. In other words, that independent contractors have

automatic access to business tax status. - The assessment for independent contractors is based on the common-law test.

(2) Further, the interpretation that the ATO applies to the legislation through the tax rulings clearly states that the ATO will treat the common-law test as the ‘results test’.

On the basis of this evidence, Independent Contractors of Australia holds the view that, for practical purposes, the ‘results test’ is, in effect, the common-law test. There are, however, two specific qualifying points that are of comparatively minor importance, but which makes the ‘results test’ legislatively more specific than common law.

The 2 qualifying points:

The common-law test (click here for details) relies on the full matrix of evidence assessed against each of a number of sub tests. ICA describes it as applying a swinging pendulum to each sub test. Some tests can point to employment, but the weight of pendulums pointing to independent contracting can override the employment pointers.

In the PSI ‘results test’, all of the pendulums must be considered (as with common law) on the balance of evidence, but two pendulums must point to independent contracting:

(1) The person must supply their own equipment;

(2) The person is or would be liable for rectifying any defect.

Each of these is, however, subject to “custom and practice” within the industry in which a person works, and within the specifics of each task being performed. That is, if the use of a client’s equipment is common practice within an industry and specific to the task being performed, then a person would pass the equipment test.

The PSI ‘results tests’ also requires that a person must produce a ‘result’. This is strange, circular wording and difficult to interpret because, in effect, the legislation is saying that to pass the ‘results’ test a person must pass the ‘results’ test.