In our news alert to you last week we gave you a broad overview of the government’s IR ‘reform’ Bill, the (Closing Loopholes) Bill 2023. We said that we’d progressively provide you our detailed analysis and this is the first instalment.

In our news alert to you last week we gave you a broad overview of the government’s IR ‘reform’ Bill, the (Closing Loopholes) Bill 2023. We said that we’d progressively provide you our detailed analysis and this is the first instalment.

This first analysis explains how the Bill aims to override and neuter the Australian High Court’s determination of who/what is an independent contractor. This is a pretty serious move. This is NOT the addressing of some ‘loophole’ in the existing Fair Work Act, an Act created by the Rudd/Gillard Labor governments in 2009.

I’ve posted a Substack article analysing this part of the Bill. It’s around an 8-minute read. We hope this will give you some clarity. It’s free to access.

First step understanding—summary

But just to understand how serious this is, at its core, the Bill seeks to destroy the very legal basis of commercial and contract law in Australia. It’s staggering, but this is what the Bill seeks to do.

The most significant proof supporting this statement is that the Bill itself states its intent to repudiate, neuter and overturn the declaration made by the High Court in February 2022 on what constitutes commercial and employment contracts. (I show the clause in the Substack post.) The High Court must be ignored, according to this Bill.

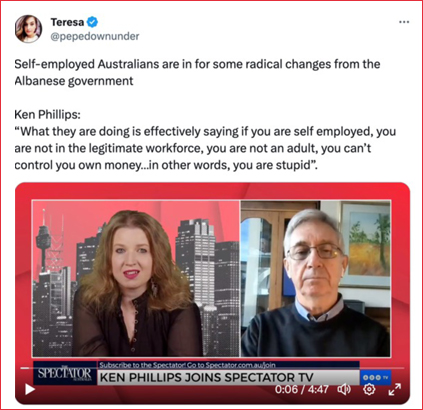

The Bill is based on an underlying position that no individual Australian has the capacity, maturity, intelligence or wit to earn their income through the commercial contract. In effect, its ‘says’ that Australians are incompetent halfwits who must be denied their right and capacity to be self-employed, to be their own boss.

It is a Bill that denies the spirit of aspiration, ambition and ‘get up and go’ that so defines much of what it means to be human. As self-employed people we probably don’t understand the extent to which our very existence affronts the existing establishment status quo. This Bill is an attempt to squash us. This is not an exaggeration, but a statement of fact based on the wording of the Bill.

The 284 pages of the Bill contain many sub-agendas scattered throughout, but all captured within the central theme stated above. It’s a complex read, but to analyse the Bill, we had to split it into its ‘bits’ by colour-coding it. By doing that we were able to identify its sub-agendas and discover its overarching theme.

The parliamentary process

The Bill is being investigated by a Senate Committee with hearings currently underway. The Committee website is here and submissions here. Curiously, our 13,000-word submission has not yet appeared on the website.

Parliament sits from this Monday 16 October for 2 weeks. I’ll again be in parliament, ‘walking the halls’, talking with Senators and MPs and their advisers on the Bill. We’ll keep you updated.

We really need to let you know what’s going on with the new

We really need to let you know what’s going on with the new  We informed you yesterday

We informed you yesterday Last Monday (4 September) I was in Parliament House, Canberra ‘walking the halls’, knocking on the doors of independent Senators and others. I was handing out an easy-to-read ‘package’ of information on our objections to the ‘employee-like’ laws proposed by the Albanese government.

Last Monday (4 September) I was in Parliament House, Canberra ‘walking the halls’, knocking on the doors of independent Senators and others. I was handing out an easy-to-read ‘package’ of information on our objections to the ‘employee-like’ laws proposed by the Albanese government.  Your Right to Be Your Own Boss is under attack.

Your Right to Be Your Own Boss is under attack. The Work From Home (WFH) movement has been coming under attack. Office real estate valuations are crashing globally and ‘workers’ are to blame, it would seem.

The Work From Home (WFH) movement has been coming under attack. Office real estate valuations are crashing globally and ‘workers’ are to blame, it would seem. Recently I was interviewed on

Recently I was interviewed on

Last week we discussed the

Last week we discussed the  Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been

Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been  In

In