July 2018

The ATO has suffered another major hit to its reputation, this time (and again) from an official government investigation.

You may remember that following the Four Corners show ‘Mongrel Bunch of Bastards’ which exposed ATO abuse of small business people, the Minister, Kelly O’Dwyer, ordered a Treasury inquiry. Both the Small Business Ombudsman and the Inspector-General of Taxation (IGT) were asked to participate.

The Inspector-General of Taxation’s report has now been released. Normally the IGT uses cautious language, but this time the report is blunt. It is quite damning of the ATO’s treatment of small business, self-employed people.

Some of the things the IGT says about the ATO include:

- In appeals processes the ATO ‘…may create a perception of bias…’

- A separate, independent agency or section should be established to handle disputes and appeals.

- Funding should be provided for vulnerable taxpayers in dispute with the ATO.

- ATO averages 69,000 garnishees a year, 86% against the self-employed.

- Garnishees are done by badly supervised, very junior staff.

- The ATO has acknowledged that its previous approach to debt collection was ‘random and ad hoc’.

- The Four Corners allegations must be independently reviewed.

- Community confidence and trust in the ATO have been in decline.

- Compensation is just a token scheme. Reform is required where compensation is NOT administered by ATO.

- Oversight of the ATO monopoly is important because it is a monopoly.

- The ATO’s media campaigns following Four Corners have damaged the ATO.

Excerpts from The Inspector-General’s Report

Independence of ATO disputes review process

- the ATO’s internal Independent Review, where the merits of the ATO’s position is considered by a senior ATO officer unconnected with how that position was initially established, are only available to large taxpayers.

- The IGT believed that, as a matter of fairness and equity, all taxpayers should have access to such pre-assessment review mechanisms.

- … the ATO has, in recent years, engaged retired Federal Court judges to undertake ex post facto reviews of settlements …the former judges themselves are commissioned by the ATO which may create a perception of bias and the reviews do not seek feedback from the taxpayers but rather operate with ATO material only.

Reform Appeals

- …the IGT remains of the view that a separate Appeals area within the ATO would significantly enhance the ATO’s approach to tax disputes as well as the public perception of it…

- ….to providing assistance or funding to vulnerable or unpresented taxpayers who may need to challenge ATO decisions through the objection process or the court system.

Debt recovery (Garnishees)

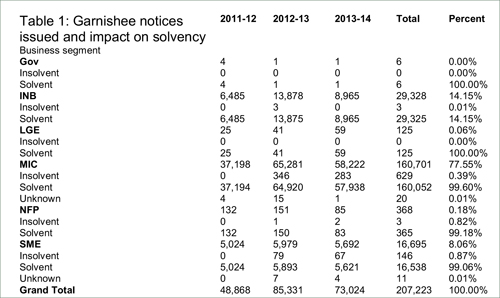

- The IGT understands that the ATO has stated that it had issued approximately 24,000 garnishee notices during the 2016-17 financial year. This is considerably lower than in previous years as depicted in Table 1

- (The low 2017 number happened because of IT failures and other ATO admin problems)

- The table above shows that the majority of garnishee notices are issued to small business (SME) including micro businesses (MIC), totalling 86 per cent of all such notices issued

- …very junior staff were making significant debt-related decisions.….no improvement to supervision of junior staff who issue garnishee notices may have been made. (since 2015)

In relation to reform

- The ATO … disagreed … recommendation (was) important in minimising the risk of inconsistent approaches being taken where there is a lack of communication between the debt and legal areas.

- A recommendation was made for the ATO to improve the commercial awareness and understanding of such staff and to develop streamlined tools to improve their assessment of business viability in lower risk cases. The ATO disagreed with developing such tools …

- It should be noted that at the time of the above review, the ATO had acknowledged that its previous approach to debt collection was ‘random and ad hoc’

- In relation to the latest allegations of abuse of the ATO’s garnishment powers as set out in the Four Corners program, an urgent, targeted and independent review is required to verify the allegations and, if proven, the extent of such abuse should be determined together with the appropriate remedial action.

- There are significant concerns45 and these are serious allegation made by an ATO officer who has provide some very damaging evidence to Four Corners including the so-called ‘hour of power’. These allegations must be independently investigated and effectively addressed to regain the confidence and trust of the community which has been in decline following major ATO I.T. outages as well as Operation Elbrus and allegations of tax fraud that may be linked to abuse of position by a public official.

Compensation

- … the primary concerns being difficulties in obtaining compensation as well as the low quantum of compensation where it was paid. These concerns together led some stakeholders to form the view that it was ‘just a token scheme’ and in place ‘for the sake of having a compensation scheme’. Statistics provided by the ATO showed that in each of the 2013-14, 2014-15 and 2015-16 financial years, the median compensation amount paid by the ATO was $267, $300 and $484, respectively.

- There are limited options for taxpayers who disagree with the ATO’s compensation decision and seek review of it.

- Under the CDDA scheme, whether compensation is paid at all or how much is paid, is wholly at the discretion of the Commissioner…

- The IGT is of the view that reform is required to the way the ATO compensates taxpayers who have suffered as a result of its defective administration.

- Given the complexities of the tax and superannuation systems, and that these systems affect almost the entire population, consideration should also be given to instituting a separate compensation regime for indemnifying taxpayers for losses they may sustain as a result of defective administration by the ATO

- Such new regime must be either administered by an agency other than the ATO or at least include a right of review to an independent agency or body

Justice

- The main issue is access to justice and the cost associated with it which can be prohibitive for many individuals and small businesses. Even to lodge an effective objection to an assessment requires a degree of knowledge and expertise which many individual and small business taxpayers do not possess and there are costs associated with seeking professional help. The costs of progressing the matter to the AAT or the Federal Court are significantly higher and likely to be out of the reach of these taxpayers

Small Business Fairness

- Furthermore, the IGT has received feedback that taxpayers feel they are ‘guilty until proven innocent’ when dealing with tax matters and that ‘even when they win, they still lose’ because of the time and costs involved in ‘taking on the might of the ATO’. Examples cited in this respect include the onus of proof resting with the taxpayer to show that the ATO’s assessment is incorrect or excessive or the ATO’s powers to commence debt recovery action while the underlying assessments are being challenged.

- A further area which has been raised with the IGT regarding unfairness is the ATO’s use of fraud or evasion (FOE) opinions based on which the ATO may examine and amend assessments outside of standard periods of review (typically 2 or 4 years). …Complaints and concerns raised with the IGT have claimed that the ATO’s processes for forming FOE opinions are not sufficiently robust and may lead to unfair outcomes. The SCTR had previously made a number of recommendations to enhance the use of FOE opinions, including reversing of the onus of proof. The use of FOE opinions had also been identified as a potential area of review by the IGT although it was held pending the outcome of the ATO’s own internal review which was commenced as a result of issues identified during IGT complaints investigations. The results of the ATO’s review have still not been made public.

ATO is a monopoly: What about Fairness?

- Oversight of the exercise of the above powers is particularly important as there is no alternative to the monopoly at play. Accordingly, the public expects a particularly high standard of conduct in the exercise of those powers. As noted earlier, the perception of fairness, including how the revenue authority deals with taxpayers, is a key factor in fostering voluntary compliance, which is critical to the efficient and effective operation of Australia’s self-assessment tax system.

- Specifically with respect to the Four Corners program, serious concerns were expressed by small business owners and former ATO officers. Their concerns appear to have been unresolved and certain cases had stretched over many years. The program seemed to be a public outlet for their frustration. Many have commented that the ATO’s initial responses were to, first, pre-emptively publicly negate the existence of a problem and discredit the people raising the concerns,and then later, refine its message to acknowledge a problem, but diminish it. Given the ATO’s extensive use of media, such attempts have been perceived to be ‘gaming’ the media or being a ‘fair weather friend’ — they have not reflected well on the ATO as an institution and for some their negative views of the ATO have been confirmed.

- In the IGT’s view, the above media strategy does not only fall short of public expectations of institutions, such as the ATO, but recent events have demonstrated that it is becoming increasingly irrelevant in our modern society. Firstly, it is now easier for citizens to publicly respond to such strategies where the administrator’s reaction does not accord with their personal experience. Secondly, improvements in technology have enabled people to evidence their experience and disprove the ATO’s response as well as providing a means to connect with others having similar experiences and coordinate responses for broader impact. Continuing to adopt such strategies runs an increasing risk of eroding public confidence as information is brought to light that discredits the ATO’s actions and how it chooses to treat disaffected taxpayers.

- The ATO needs to rethink its media strategy recognising that extensive use of media does have it downsides and when they do so they should genuinely address issues raised without diminishing them or singling out specific groups or organisation for rebuke. The ATO must show its care and compassion for the public that it serves both in words and in actions if it is to maintain the confidence of taxpayers, which itself is the lynchpin for Australia’s self-assessment tax system.

Conclusions

- compensation as an issue needs to be addressed

- tax disputes between the taxpayers and the ATO require improvement particularly for small businesses and individuals who lack the resources to challenge ATO decisions

- trust and confidence needs to be restored in the ATO’s approach to debt collection.

- the ATO must appreciate the power that it holds over the vast majority of citizens with whom it interacts and reconsider its strategy when concerns of the nature identified in the Four Corners program are raised.