Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been a strong critic of the Victorian government on this.

Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been a strong critic of the Victorian government on this.

In July 2020 the Victorian government released its report into the gig economy. (Just to remind you, we explained what gig work is last week—e.g., Harry Styles, etc). The research from the report is actually very good. (7% of the workforce ‘do’ gig, but less than 0.2% do gig for full-time income. That is, it’s ‘top up’ income for the bulk of gig workers.)

BUT, Recommendation 6 of the Victorian report effectively called for the outlawing of independent contracting (self-employment). However, contrary to this recommendation, the policy now released by the Victorian government is very sensible. It doesn’t do anything to harm self-employed people, doing gig or direct work, but puts in place good protections within a commercial framework.

This is exactly the sort of thing we support and want to see. And it’s completely counter to what the Albanese government has plans to do, which will be highly destructive of small business.

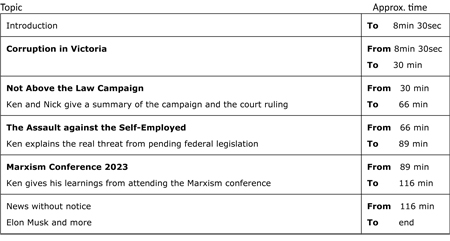

Here’s the Victorian government’s policy. It covers ‘gig’ platforms (e.g., Uber, etc). It has six standards as follows:

Victorian Government gig platform code—Standards

- Platforms should provide consultation processes, forums or committees to allow for discussions with non-employee on-demand workers…

- Platforms should ensure that the terms and conditions of the applicable contract are clear and able to be understood by non-employee on-demand workers

- To assist non-employee on-demand workers to make an informed decision about whether to accept work, platforms should provide them with key information in writing about:

I. what they will earn should they complete a job, and how earnings are calculated

II. typical costs associated with the performance of work

III. their conditions of work

IV. the factors that affect how work is allocated by the platform (such as customer ratings).

- Fair and Transparent Independent Dispute Resolution.

- Platforms should not inhibit non-employee on-demand workers from freely associating to pursue improved terms and conditions relating to their work arrangements, where permitted by law.

- Platforms must comply with their duties under the OHS Act.

Now this is common sense, as opposed to the Albanese government’s planned nonsense.

This Victorian government policy now forms a major part of our advocacy work in the Federal Parliament. We’re actively talking with independent Senators asking them to oppose the Albanese government’s plan. We’re now promoting the Victorian Standards to Senators as the way to go forward.

Our campaign is only just warming up with a full range of trips to Canberra and other places organised and being planned. Many thanks to the support we’ve been receiving from many of you which enables this critical work.

In

In  We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda.

We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda. It can take a long time for justice and the rule of law to hold people accountable (particularly powerful people), where such accountability is proven to be warranted.

It can take a long time for justice and the rule of law to hold people accountable (particularly powerful people), where such accountability is proven to be warranted.

We

We  We’ve

We’ve  This is to alert SEA members and subscribers about new laws affecting you if you earn income through ‘gig’ platforms. As of 1 July 2023, the platforms will be required to report your income to the Australian Taxation Office. The move is directed to identifying undeclared income and will eventually apply to GST compliance.

This is to alert SEA members and subscribers about new laws affecting you if you earn income through ‘gig’ platforms. As of 1 July 2023, the platforms will be required to report your income to the Australian Taxation Office. The move is directed to identifying undeclared income and will eventually apply to GST compliance. At Self-Employed Australia we’re covering what seems to be a wide range of topics. In fact, these all come back to a central ‘thing’ that we seek to protect—namely, your right to be self-employed should you wish. That is, your right to Be Your Own Boss.

At Self-Employed Australia we’re covering what seems to be a wide range of topics. In fact, these all come back to a central ‘thing’ that we seek to protect—namely, your right to be self-employed should you wish. That is, your right to Be Your Own Boss.

We’ve

We’ve  I let you know a little while ago that I’ve started posting as a Substack writer. Substack is for obsessive writers (like me). I’ve called my Substack

I let you know a little while ago that I’ve started posting as a Substack writer. Substack is for obsessive writers (like me). I’ve called my Substack  I explain that:

I explain that: This article looks at the labour academic argument that self-employed people can be a ‘little bit an employee’. I explain that:

This article looks at the labour academic argument that self-employed people can be a ‘little bit an employee’. I explain that: You may not be aware that I published a book on this in 2008. I’ve decided to make this available through Substack in serialised, chapter format. I’ll progressively release chapters. In this first release I provide the book’s Introduction. In it I quote Roman Emperor Caligula who stated:

You may not be aware that I published a book on this in 2008. I’ve decided to make this available through Substack in serialised, chapter format. I’ll progressively release chapters. In this first release I provide the book’s Introduction. In it I quote Roman Emperor Caligula who stated: