Have no doubt that the future of your right to be your own boss, to be a small business person, is in the hands of the seven independent Senators in parliament.

Have no doubt that the future of your right to be your own boss, to be a small business person, is in the hands of the seven independent Senators in parliament.

On Monday and Tuesday this week I ‘walked the corridors’ of Parliament House, Canberra, meeting with Senator’s advisors and others on the government’s 284-page, highly complex Loophole (Industrial Relations) Bill. I’ll be returning to Canberra several times before Christmas.

We’ve provided you an overview of the Bill and a detailed analysis of how the Bill trashes contract law as defined by the High Court. We’ll be supplying more analysis progressively. But be very clear on the central thrust of this Albanese government Bill.

This is the greatest attack against Australian small business people ever seen. More details below.

What should be happening are proper protections for small business people. One of these is the unfair contract laws. Seriously stronger unfair contract law come into effect on 9 November and, across the board, companies are upgrading their contracts. But government departments are not subject to these laws. That is, government departments can have unfair contracts with small business people and get away with it.

On Monday morning (16 October), independents Senator David Pocock, Senator Jacqui Lambie and MP Allegra Spender co-sponsored a small business breakfast in Parliament. The large room was packed. I had a chance to push this issue.

I put it to the Senators that this must be fixed. A one-paragraph amendment to competition law would stop this double-standards shocker.

Here I am putting this proposition. Senator David Pocock is behind me on the left of the picture.

But back to the Bill. The consequence of this Bill is that:

- 2 million self-employed people will be declared to be employees. This will kill incomes.

- 970,000 people who use gig work for top-up income will have their incomes trashed.

- 8 million casuals will be forced to be full/part time employees, losing 6 per cent of their income.

For just the casual workers, people on:

- minimum pay will lose up to $3,062 a year;

- average pay will lose up to $5,354 a year.

That is, the Albanese government is engaged in a massive attack against people’s incomes.

This is no exaggeration. These conclusions are based on hard analysis of the words in the legislation with clear documentation on what this means. But be alert. The Albanese government is conducting a scandalous misinformation and disinformation campaign to push this Bill through.

We have more detailed explanation papers that we’ll release shortly. You can judge for yourself. We’ve already supplied these to the independent Senators and MPs and they are listening.

In our

In our  We really need to let you know what’s going on with the new

We really need to let you know what’s going on with the new  We informed you yesterday

We informed you yesterday Recently I was interviewed on

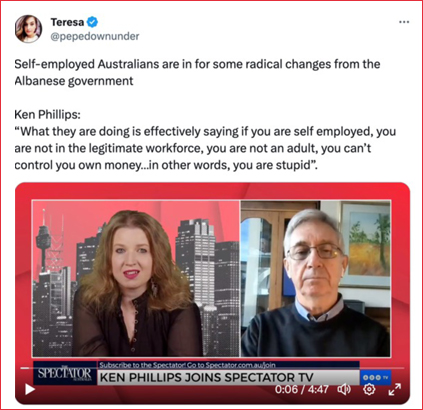

Recently I was interviewed on

Last week we discussed the

Last week we discussed the  Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been

Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been  In

In  We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda.

We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda. We

We