The Work From Home (WFH) movement has been coming under attack. Office real estate valuations are crashing globally and ‘workers’ are to blame, it would seem.

The Work From Home (WFH) movement has been coming under attack. Office real estate valuations are crashing globally and ‘workers’ are to blame, it would seem.

But what is WFH? It’s nothing more than millions of workers taking advantage of technology that allows office work to be done anywhere, anytime. Effectively ‘we’ workers are acting like consumers and exercising our individual choices as to how we earn our incomes. In truth, we’re witnessing the crashing of market forces (millions of people making billions of individual choices) into the labour environment. To real estate moguls I say: ‘suck it up’ and adapt!

WHF goes further. It’s challenging the underpinnings of labour law and management, at least in the office setting. It is a moment in time, a revolution!

Even if you’re legally tagged an ‘employee’, in fact working from home takes on more of the features of self-employment (being your own boss) than employment. Progressively more and more WFH people will become formally self-employed.

I discuss this in greater length (in between putting on a load of washing – I work from home as a self-employed person!) on my Substack site. You can link here (it’s free).

But there’s another angle I don’t discuss on Substack—the gig economy. Quite often substantial aspects of WFH involve gig work. Think of WFH translators, transcriptionists and private tutors. They almost exclusively work from home, sourcing and managing their work through gig platforms. And they are almost universally self-employed. Yet the federal government’s agenda is to attack these people.

You’ll probably be well aware of our campaign to attempt to have this agenda blocked in the Australian Senate. The WFH movement adds further weight to our argument that the government’s agenda is nonsensical and defies the choices that workers (people) are making to have control of their own working lives. This is a ‘movement’ of individual choices by huge numbers of people.

Here’s the summary of our other reasons for opposing the government’s anti-gig, anti-worker agenda.

And a quick campaign update for you…

- We’ve been in contact now with all of the seven independent Senators’ advisers. Discussions have been very professional and constructive. At this stage of advocacy our experience is that it’s necessary to engage with the Senators’ policy staffers.

- There’s no legislation at the moment, but when it appears we’ll be doing further analysis and briefings.

- We need the Opposition and six of the seven independent Senators to oppose any legislation in order to block it.

- So far, we’ve conducted three trips to Canberra to meet Senators’ policy staffers in person. When the legislation appears, the pace of this will pick up. Phone calls, emails and Zoom chats have been frequent.

Touch base with me if you’re interested in more information.

Recently I was interviewed on

Recently I was interviewed on

Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been

Here’s one for the history books. We’re actually complimenting the Victorian government on its ‘gig economy’ policy. Until now we’ve been  In

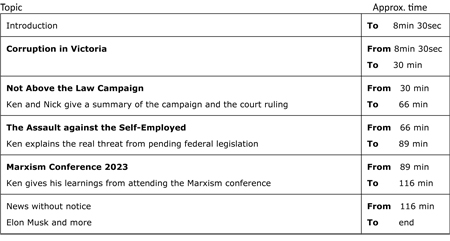

In  We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda.

We thought we’d give you an understanding of the mechanics of our campaign to try and stop the Albanese government from implementing its ‘employee-like’ agenda. We

We  We’ve

We’ve  This is to alert SEA members and subscribers about new laws affecting you if you earn income through ‘gig’ platforms. As of 1 July 2023, the platforms will be required to report your income to the Australian Taxation Office. The move is directed to identifying undeclared income and will eventually apply to GST compliance.

This is to alert SEA members and subscribers about new laws affecting you if you earn income through ‘gig’ platforms. As of 1 July 2023, the platforms will be required to report your income to the Australian Taxation Office. The move is directed to identifying undeclared income and will eventually apply to GST compliance. At Self-Employed Australia we’re covering what seems to be a wide range of topics. In fact, these all come back to a central ‘thing’ that we seek to protect—namely, your right to be self-employed should you wish. That is, your right to Be Your Own Boss.

At Self-Employed Australia we’re covering what seems to be a wide range of topics. In fact, these all come back to a central ‘thing’ that we seek to protect—namely, your right to be self-employed should you wish. That is, your right to Be Your Own Boss.

We’ve

We’ve